Lendscape Client Portal

Client Portal is an intuitive web application that communicates through a secure digital gateway allowing your clients to self-serve their funding needs, while lenders benefit from operational efficiencies and high levels of client satisfaction by using a white labelled presentation of the Client Portal application.

Deliver multiple products and connect with your customers

Using a single login, your customers can access a range of products including receivables finance, asset-based lending, supply chain finance and construction finance.

Client Portal features

For example, products can be securely accessed remotely at any time, allowing your customers to view their live and historical data. They can draw down on their available fund, run reports, upload data with substantiating documents and respond to your notifications and messages.

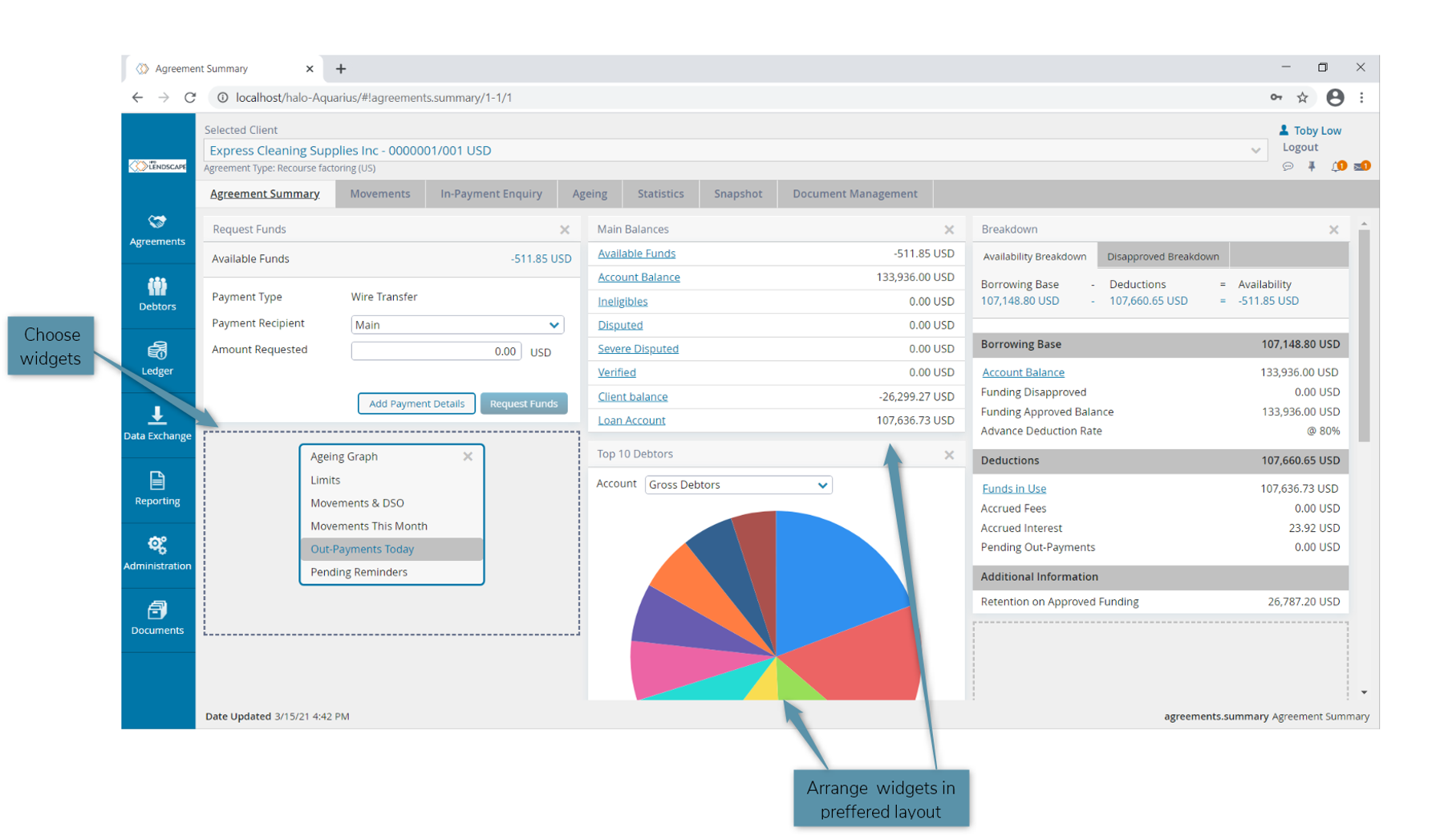

Empower your clients to manage their funding with real-time balance and advances

Your clients will have real time access to all the facilities you offer including Supply Chain Finance, Invoice Finance and Factoring, Trade Finance Receivables, Payables, PO Finance, and customer account package data extraction. Your users can see their live calculated balances on their current position and request advances on their available funds, all while providing you with updated snapshots of the financial health of each customer.

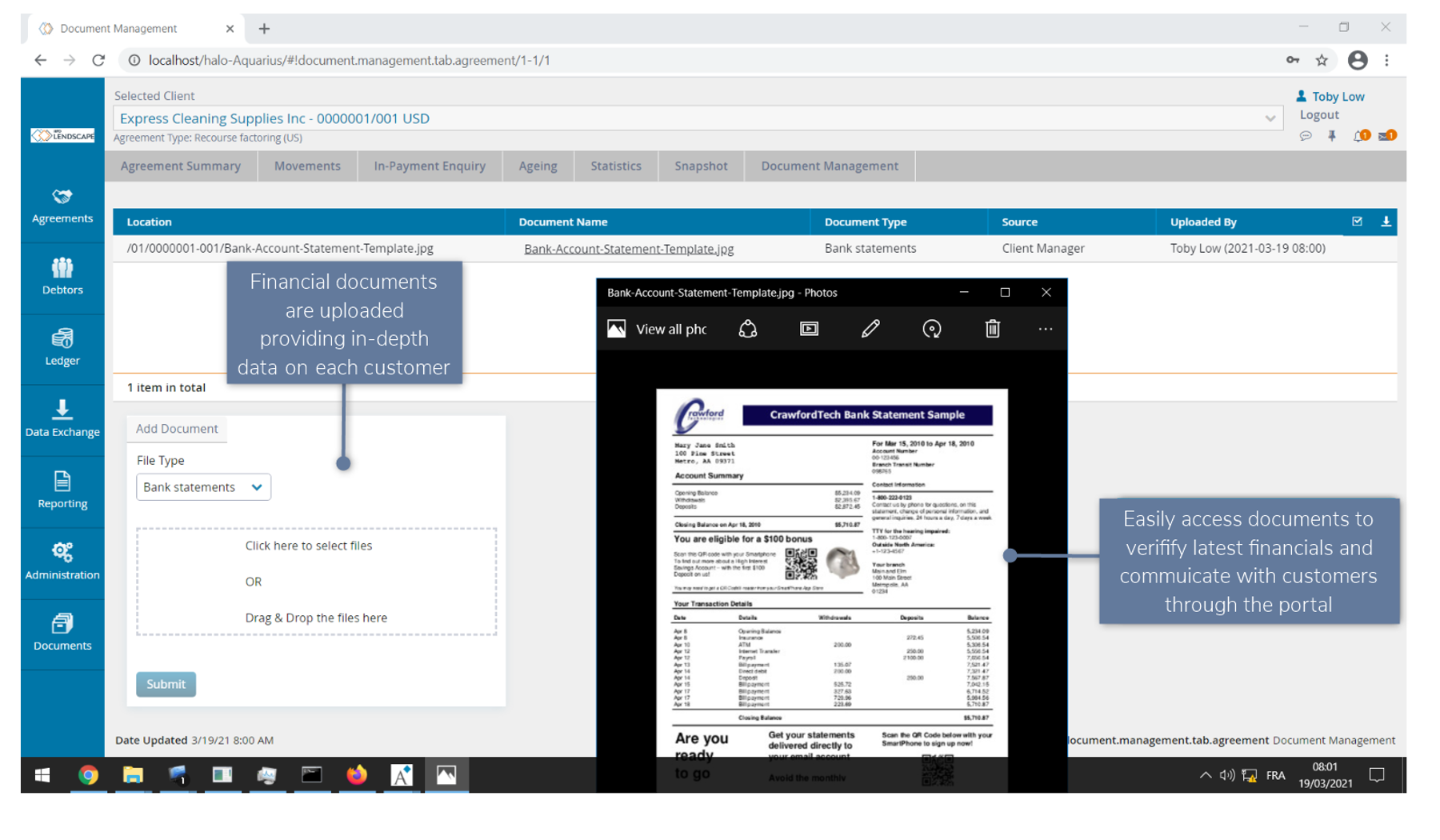

Operational activities

There are multiple operational tasks which can be managed such as entering invoice collateral, uploading substantiating documents via the document management system (DMS), performing payment reconciliations, managing write-offs, and amending collateral details. Your customers can also create their own internal users to perform tasks in the portal on their behalf. Documents can be shared internally and externally to assist invoice verification for faster funding decisions.

Reports and statistics

The portal provides a wealth of data including analysis on debtors, movements, days sales outstanding (DSO), snapshots, ageing analysis (including collection performance and payment forecasts), ledger item analysis, in-payment and out-payment enquiries, and a 365-day statistics view.

An intuitive user experience

From a selection of available “Widgets” (e.g. Top 10 Debtors, Availability Breakdown, Out-Payments Today) your clients can choose the information to display on their dashboards and customise to show the widgets that are important to them.

Users can also order and select the columns displayed to them on any query they perform, then customise those selections and export into .xls, .pdf or .csv.

Improve customer communication and unlock future sales opportunities.

Share reports, documents, internal alerts and reminders as well as system wide broadcasts i.e. to let businesses know the availability of new products and features. Client Portal enables you and your client to be kept up to date with activities on their accounts, they can receive scheduled or triggered reports and letters, send and receive messages as well as act upon actions that have been sent to them, which could include uploading documentation to help verify an invoice.

Secure access from anywhere, anytime

Another factor which users find useful is having access to their facility 24/7 on secure platforms. The responsive technology enables the portal to automatically adapt its display and navigate to whichever device is being used, be that a PC, tablet, or smartphone.

Take your business to the next level with real-time reporting across multiple devices

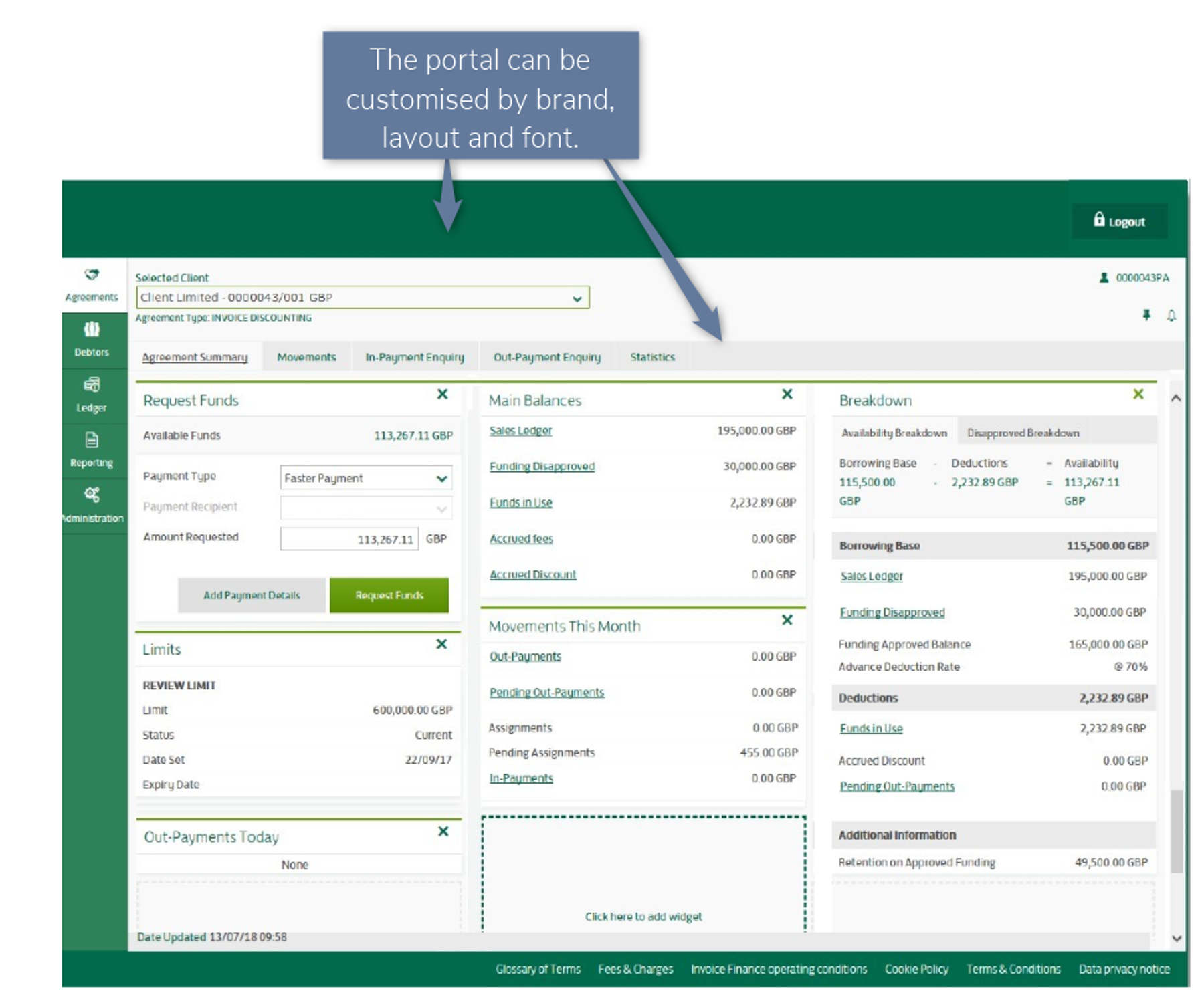

A white-label solution

Finally, the portal’s branding, fonts and layout are fully customisable so can be branded per programme or legal entity. This means that subsidiaries of a lender could have their own unique branding. And if a number of buyer-led financing programmes were also being run by the lender, these too could each have their own unique branding, so that their suppliers only see the branding of their buyers when logging on.

To see videos of Client Portal in action click here

Client Portal at a glance

For the Lender

- Front end for your full range of products

- Real-time monitoring

- White-label solution

- Comprehensive customisation

- Granular access control

- Reduced overheads/workload

For Your Clients

- Manage facilities + user admin

- Real-time balances & drawdown

- Intuitive + customisable UI

- Reports & statistics

- Secure access from anywhere, any time