4 Steps to debtor payment success

The handling of cash transactions and the ability to correctly allocate and reconcile debtor payments to invoices, held on a Receivables Finance facility, generate considerable overheads. This is because invoice financiers tend to employ costly cash processing teams to allocate payments to invoices held in the system, based on manual or semi-manual review of remittance advice information.

In some countries such as the UK, financiers have increasingly moved away from handling customer cash processing by promoting Bulk Invoice Discounting type products where detailed cash processing is managed by the end client. However, due to different legal frameworks and approaches to risk including fraud, it’s often not an option.

It is vital for businesses to have an efficient means of automatically allocating cash through to the right debtor accounts and ultimately reconciling to the right invoices.

In this blog, we’ll provide a high-level overview of the debtor payment functionality as well as options to enable users to achieve greater allocation success rates, leading to increased operational efficiency.

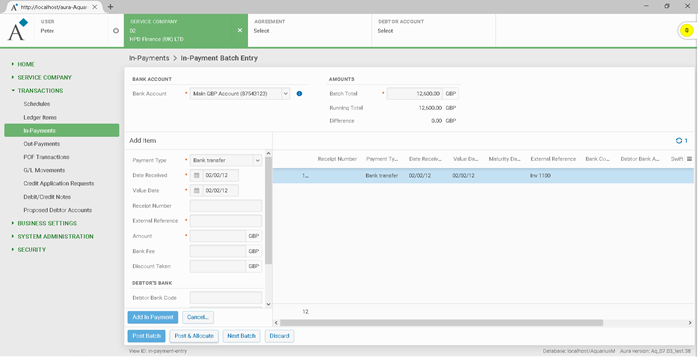

1. Debtor payment entry

The Lendscape platform allows the creation of an unlimited number of bank accounts to facilitate the allocation and reconciliation process. An important feature is that the system integrates with any banking or cash management system to import bank statements or debtor payments in electronic formats. Lendscape has a great variety of standard payment interfaces, all configurable, either file-based, in-line triggers or APIs. The system supports GIRO unique key payment references and SWIFT messages to name a few.

Debtor payments can also be entered manually by internal users.

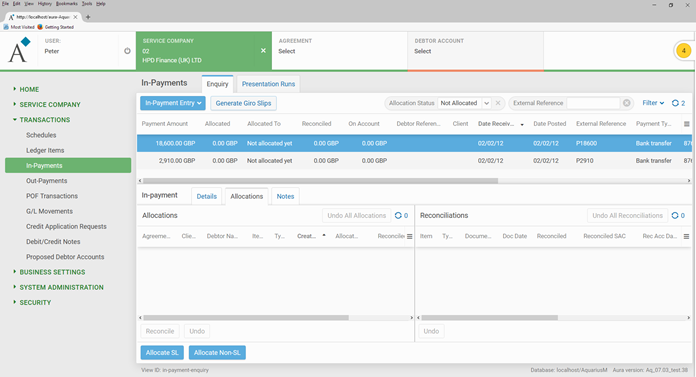

2. Automatic allocation and reconciliation

Based on the debtor payment information received automatically, uploaded from file, or entered manually, Lendscape will run the matching algorithm to allocate on client-debtor relation and reconciliate the debtor payments with the open items.

The system can use all available data to allocate and reconcile with invoices automatically. Information such as invoice number, debtor Id, VAT, name, amount, and the bank account from where payment has been received are used to automate the process. To that end, the system can use sophisticated text analysis of the payment narrative for more complicated scenarios. Banks wanting to improve their success rate, may decide to setup separate intermediary accounts for each client which will also be used in all necessary documentation such as notifications and reminder letters.

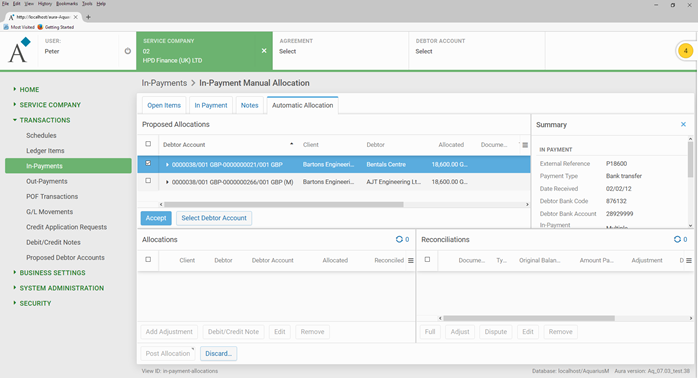

3. Mismatches handling

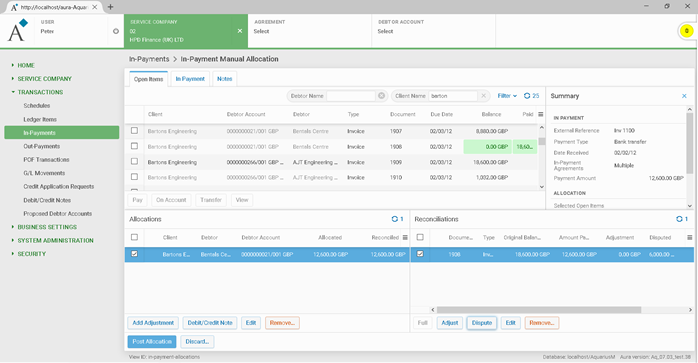

Below is a brief overview of the flow, an example of in-payment allocation that requires manual intervention due to invalid or missing data.

Debtor received

In case of mismatches, the system recommends allocation, but the user will have to manually confirm and select the correct option to make changes.

The system suggests allocation and users need to select the right option

Review Allocation and Reconciliation, then post!

The system has a learning mechanism within the manual correction process to improve the automatic matching algorithm for application in future allocations on the specific account.

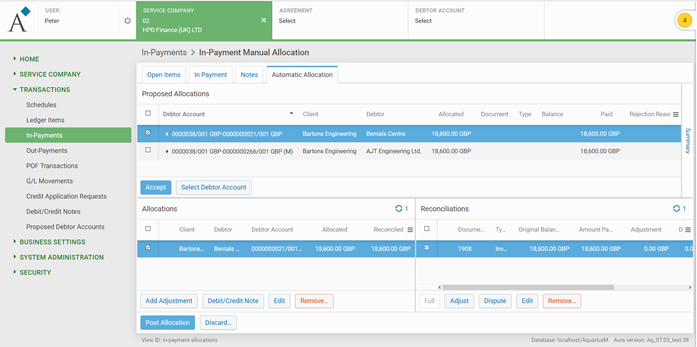

4. Manual allocation

In case the matching isn’t automatic, internal users will be able to manually allocate and reconcile payments with open items adding adjustments or disputes, perform full or partial allocations.

The user actions for shadow ledger, non-shadow ledger allocation, full or partial reconciliation, adjustments and disputes can be managed quickly and effectively within the same application screen in Lendscape – enabling your business to generate higher automatic allocation rates thus enhancing operational efficiency.

Want this as a pdf?

Want to find out more about in-payment allocation in Lendscape?