Lesen Sie diesen Artikel auf Deutsch

Syndicated finance - in which a group of lenders pool resources to support larger, capital-intensive projects – totaled an estimated $4.7 trillion globally in 2022.

In this blog, we delve into the benefits and challenges of syndicated deals and explore how modern technology is enabling more providers to tap into this growth opportunity.

What is Syndicated Finance?

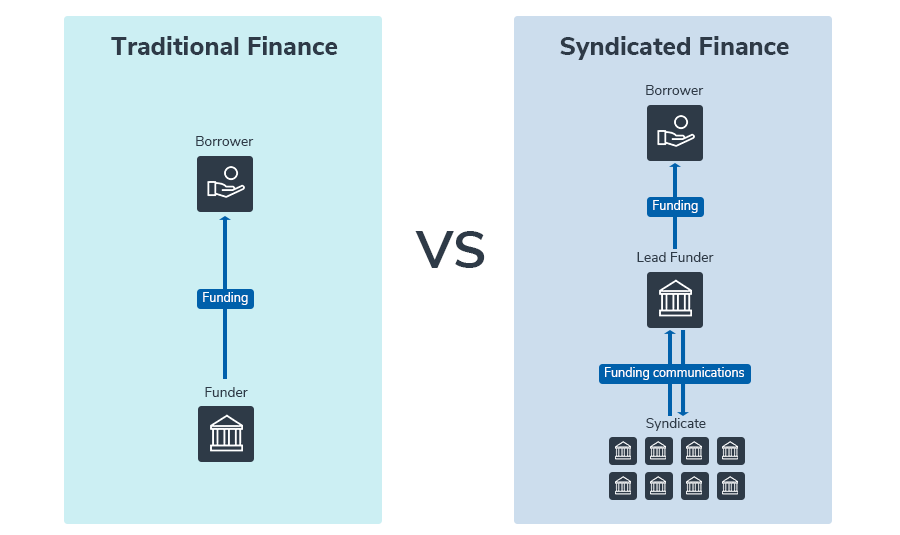

Syndicated deals involve multiple lenders serving a single borrower's financial needs. This collaborative form of financing enables providers to spread risk, optimise capital usage, and cater to financing requirements that might exceed their individual lending capacities and risk appetites.

For example, Leumi participated in a £90m BZ led deal to refinance EVO, the UK’s largest multi-channel distributor of business supplies and services, and a more recent example would include a deal in which Grupo UNACEM obtained $345m in funding to acquire a cement plant in the US.

How Does Syndicated Finance Work?

A Lead Funder (or ‘Lead’) manages the finance process, including deal administration, payment collection, and cash flow distribution among syndicate participants. The Lead can increase the profitability of the deal by receiving additional fees and compensation for these services.

How a syndicated deal works would depend on its type. With that, there are two types of syndication, funded participation and risk participation.

- Funded Participation: Participants agree they will fund the lender in relation to funds already drawn down or drawn downs yet to be made in the future up to an agreed limit. The Lead funder usually has the largest share of the risk, and participants complete the funding pool at a level that matches their appetite, for which they receive a share of the revenue.

- Risk Participation: Participants share the risk of the deal with the Lead up to an agreed limit and agree to reimburse them for any defaults by the borrower, for which they receive a share of the revenue.

Figure 1 below illustrates a simplified view of the difference between a traditional finance facility and a syndicated finance facility (in this case, a funded participation).

Benefits of Syndication

For Finance Providers:

- Capital Optimization: Collaborative financing enables efficient use of capital, allowing finance providers to engage in larger transactions without overextending their balance sheet. It also allows the risk appetite of each participant to be reflected in the deal structure.

- Risk Mitigation: Syndication allows lenders to diversify their portfolios, spreading risk across multiple deals and industries and reducing exposure to potential losses.

- Network Expansion: Participating in syndicated deals fosters connections with other finance providers, opening doors to new opportunities.

For Borrowers:

- Access to Larger Funds: Syndicated finance accommodates substantial funding needs that may be beyond the capacity of a single lender, offering borrowers access to a broader pool of capital.

- Flexible Terms: With multiple lenders involved, borrowers may be able to negotiate more favourable terms, including interest rates and covenants.

- Speed and Efficiency: Syndicated deals often streamline the lending process, leveraging the expertise and resources of multiple lenders to expedite due diligence and approval.

Challenges of Syndicated Finance

While syndication offers attractive prospects for both funders and borrowers, it comes with challenges:

- Complex Co-ordination: Working with participants using varied templates, processes and systems, sometimes across multiple jurisdictions, demands substantial effort and can cause delays.

- Operational Inefficiencies: Syndication often relies on spreadsheets and cumbersome manual tasks involving numerous hand-offs and data verification, leading to elevated costs and the risk of human error.

- Risk and Compliance Hurdles: Manual workflows and a lack of a comprehensive audit trail make it more difficult to manage risk management and stay on top of regulatory compliance.

The Digitalisation of Syndication

New technologies are revolutionizing syndicated lending for finance providers, offering a suite of tools to streamline operations and boost efficiency. The simplicity, reliability and accuracy of syndication technology platforms - like Lendscape - have expanded capabilities, allowing for the syndication of diverse loan structures with ease, from simple single-facility deals to complex multi-currency transactions and the advent of automated workflows has been a game-changer, saving valuable time and cutting operational costs.

These platforms also enhance risk management by minimizing human error through robust audit trails and providing real-time visibility of funding positions. Moreover, compliance with regulations like the Digital Operational Resilience Act (DORA) ensures data security and fortifies client trust.

In summary, syndicated financing presents opportunities for both finance providers and borrowers. For finance providers, syndication facilitates efficient use of capital, diversifies risk and potentially expands their network, while borrowers gain access to larger funds and more flexible terms, enhancing their ability to meet financing needs.

However, syndication also brings complexities, including coordination challenges and operational inefficiencies. Finance providers can leverage modern technology in overcoming these hurdles to capitalise on the benefits of syndicated financing while mitigating its inherent challenges.