ENG | DE

Streamline and automate the management of syndicated deals

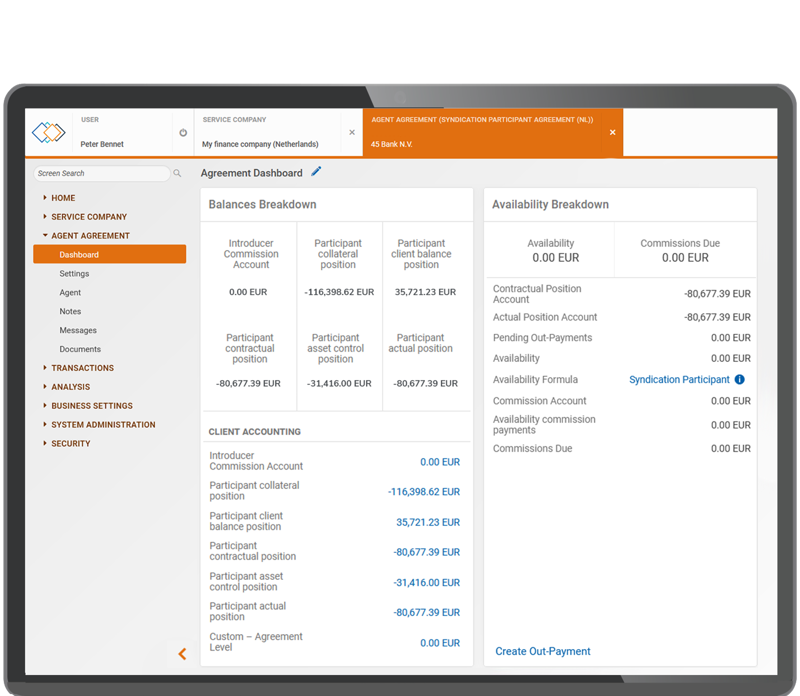

Syndication enables providers to meet customer demand for larger capital amounts by pooling resources with other lenders. With our market-leading platform you can automate and modernise the administration of syndicated deals, reducing costs and complexity.

Efficiency. Flexibility. Visibility.

Save time and costs

Replace resource-intensive manual tasks with automated workflows

Syndicate all forms of secured lending

From straightforward single-facility transactions to multi-facility, multi-currency group structures

Mitigate risk

Minimise human error through increased automation. Benefit from robust audit trails and effective risk management.

Elevate security

Our platform supports compliance with regulations including the Digital Operational Resilience Act (DORA), fortifying your data

Accelerate decision-making

All participants have a clear view of funding positions, leading to faster approvals

0+ clients

in over 40 markets

0yrs

of industry experience

$0bn+

of lending managed annually

Lendscape Syndication Features:

- Set up and manage any number of deal participants

- Online Portal: Participants can view detailed ledger item reports, extracts and reports quickly and conveniently

- Cash position tracking: required vs actual commitment

- Highly configurable: Manage single-facility or complex multi-facility, multi-currency group structures

- Options for syndicating different facilities: from asset-based lending (ABL) to full factoring and supply chain finance

- Automated Syndication Settlement: allows for daily cash movement between lead funder and participants, protecting the lead lender from greater risk

Ready to transform your syndication operations?

Explore our other products

Open Accounting

Use in-depth ledger data for fast and secure funding decisions.

Pull data from account packages

Client Portal

Give your clients intuitive and real-time access to your services, wherever they are.

A user-friendly customisable portal